As many Americans grow concerned about the new tax reform and how it will affect their tax position we at De’Mario Black, CPA have taken initiative and created this article to highlight the changes and how they may impact you and your family.

Tax Brackets with Lower Rates

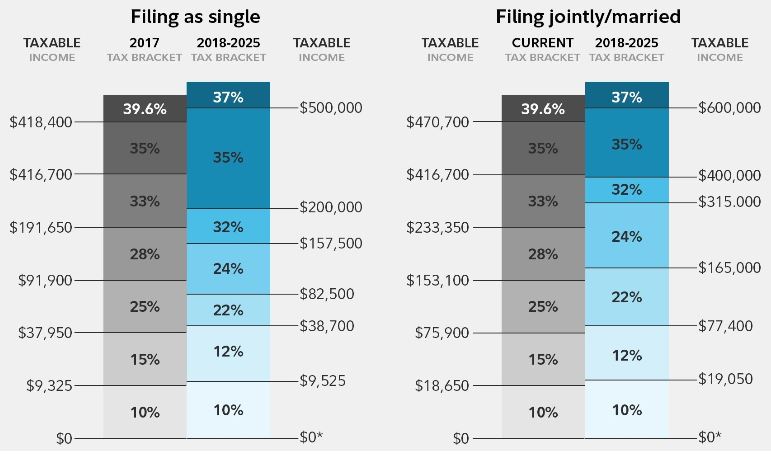

The new tax code will reduce the marginal income tax as seen in the chart below. These changes made to the newly-established tax brackets are temporary and will revert to current law after December 31, 2025. View the chart below to see how your tax bracket may be affected.

Changes to Standard Deductions & Credits

Under the new tax law, personal exemption and standard deduction are combined into a single, higher standard deduction. The child tax credit increases and there will be a new dependent tax credit. The higher standard deduction for people age 65 and older will still exist, with a small increase. As with the changes listed above, these changes will expire after December 31, 2025, reverting back to the 2017 tax law.

| Rules for 2017 | New rules for 2018‐2025 | |

| Standard deduction | $6,350 per individual

$12,700 married couple filing jointly (MFJ) |

$12,000 per individual

$24,000 married couple filing jointly |

| Child tax credit | $1,000 | $2,000 |

| Senior citizens (over age 65) | Additional$1,500 (individuals),Additional $2,500 (Couple MFJ, both spouses over age 65) | Additional $1,600 (single) Additional $2,600 (Couple MFJ, both spouses over age 65) |

| Dependent tax credit | None | $500 per non‐child dependent |

The new law will change the balance between itemized and standard deductions. With an increase in standard deductions, Americans should consider bypassing the itemized deductions. This is because charitable gifts, medical expenses, home mortgage interest, and other itemized deductions will all face a higher threshold before they become useful.

The chart below examples of changes in some of the most popular deductions.

| Deductions and credits | Rules for 2017 | New rules |

| Mortgage interest | $1 million primary, and second homes and some home equity debt | Limited to $750,000 of mortgage debt for primary and secondary homes. This provision would be applicable for taxable years after December 31, 2017 and beginning before January 1, 2026, when the limit would return to $1,000,000.

Eliminates deduction for interest on home equity loans until taxable years beginning after December 31, 2025. |

| Medical expense deduction | Expenses greater than 10% of AGI are deductible | Expenses greater than 7.5% of AGI could be deducted for 2017 and 2018. |

| Adoption expense tax credit | Expenses up to $13,570 qualify | No change |

Retirement Saving:

The new rules do not call for changes to existing retirement savings incentives, preserving the favorable tax treatment and contribution limits for 401(k)s, IRAs, and other retirement savings accounts. The law also keeps in place the current rules for health savings accounts.

Corporate, S Corp, LLC, Sole Proprietors, Partnerships Tax Rate:

Under the new law, corporate tax rates will be cut to 21%. Unlike the changes listed above, this specific tax cut is not scheduled to expire. Pass‐through businesses, businesses structured as sole proprietorships, partnerships, and S‐corporations, will be taxed at individual tax rates, but will be able to deduct 20% of income. The plan would let businesses fully expense new equipment immediately instead of depreciating over time.

Key Takeaways:

There are a few things you may want to while under the new tax law:

- Rethink your mortgages and deductions: If you have traditionally made charitable gifts or benefited from the mortgage interest or state and local tax deduction, you want to look at how the new standard deduction will impact you.

- Small‐business income: If you own a small business, you may want to reconsider how you structure your income and the form of your enterprise. Depending on the size and specifics of your business, you may want to consider the benefits of incorporation or the restructuring of pass‐through organizations.

- Timing corporate expenses: With new rules in place temporarily for expensing capital equipment purchases, business owners may want to review their capital expenditure plans.

Consult with us today to maximize your potential this tax season and to ensure you are in position to benefit from the changes.